1. The FIIs sold and sold huge. 4252 crores sold in May itself and last 3 days around 3600 crores. The rupee tanked from 44.20 odd levels to mid 45 levels. The FII money is what has led this rally. This year they have net bought around 4500 crores. The Dollar Index has moved onto 84 levels. A strong dollar means the dollar carry trade unraveling. The DIIs have bought around 12000 crores this year.

2. Gold has jumped to 1210 dollars per ounce. Gold ETF closed around Rs 1740. We have been recommending to buy Gold for past 3-4 months from around Rs 1600 odd levels. More the mess in Europe, more Gold prices will increase. Gold prices have been moving up in spite of a strong dollar.

3. RIL - RNRL judgment has gone in favor of RIL. RIL is a buy on all dips. Oil and gas is where the money is. Whenever market falls RIL should be accumulated.

4. The European mess is just increasing. Germany is being portrayed as the saviour of europe. If we think a bit, I would say Germany is more to be blamed for the mess Europe finds itself in. Why? China is being pilloried for a weak Reminbi which makes their exports cheap. Germany is having the same benefit. Weak Euro cushions Germany's exports at the cost of other EU nations. Germany has a trade surplus with all its partners. The Euro itself is a flawed currency and needs reform. Thanks to Germany, the other EU nations cannot export more and have to cut spending. The EU is signing up for a recession of several years.

5. EU in recession is bad news for the US and the globe. If they cannot export to EU, then a large market is hut out for them.

6. The Telecom Auction is going rake in the government about 50000 crores from 3G and around 15000 crores from the WiFi Auction. This would take the earings to almost double of 35000 crores projected. The Fiscal Deficit would be taken care of. The 2G Auction cost the people of India almost 30000 crores thanks to faulty mechanisms. No one seems quite concerned about.

7. The Dow dropped around 1000 points on Thursday intra day and then closed down 350 points. Again on Friday, dropped 150 points. So in reality it has lost 500 points on a closing basis in last 2 days. This means there is something which we do not know. There is no glitch but someone is indeed selling out. Someone big and someone who knows something which we do not know.

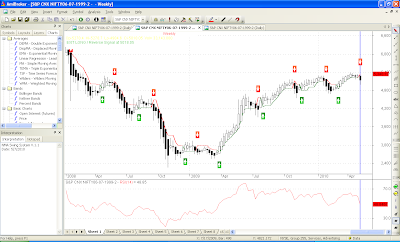

Technically:

1. We seem to be taking support at the trend lines from July lows right now.A break of that and next strong supports are at 4800 levels.

2. The 200 DMA at 4961 and 200 EMA at 4881 are supports.

3. Look at the 3 times, the Nifty as broke trend lie support from March 09 lows. Each time a break has yielded around 500 points. This time if this plays true we have a range of 4700-4800 as supports.

4. The Weekly NMA has given a sell. Typically a sell signals yields around 200 points more again taking us to 4800 odd levels.

5. Look at the Weekly Bollinger band levels. From MArch 09, each corrections are taking us closer to the lower band.This very beautifully illustrates how the Rally is weakening. Supports at bottom are at around 4700 levels.

6. 4951 is the 61.8 % retracement level from 4675-5400.

In a nutshell, 4961, 4881, 4800, 4700 are supports. We can hope for some bounces above 5072, 5109.

Keep adding RIL and Gold at every dip.

No comments:

Post a Comment