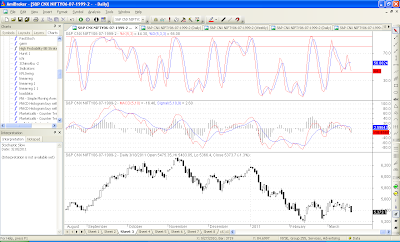

The Markets took a sudden dip on Friday. Will they break out of the 5300-5600 range. It has been totally range bound for the past few weeks since the budget. I studied a few technical indicators and all of them seem to showing the markets headed lower.

1. The NMA Indicator is a pretty reliable indicator. The Daily is in Sell Mode and the Weekly well as never given a buy signal from the previous sell signal.

2. The 5 days moving average minus the 20 days moving average has been pretty reliable. It has give the Sell sign by going on a reducing trend.

3. The trend line indicates support around 5320 levels.

4. The Bollinger Band gives us support at 5300.

5. The Daily Stochs and MACD are in sell mode. MACD has just moved into negative territory. A move into negative area usually gives a substantial negative movement.

6. I have made some Elliot labeling. As per labeling, if wave 5 began at 5608 we are headed to 5000 on the Nifty or 16635.

To sum up the Technicals, I would watch 5300-5320 area closely. A close below 5308 would open up downsides to 5000.

nice but well some indicators are too sharp

ReplyDelete