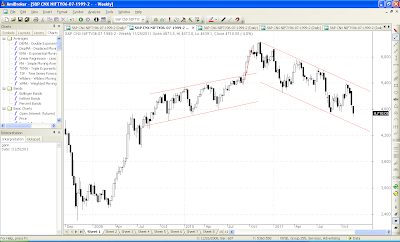

The Markets fell about 4 pc to close at 4710 for the week. This was on the back of a 5 pc fall last week. The Markets are deeply oversold in the short term and are due for a bounce.

1. The markets have been falling hitting 5400. This is the 5th wave of the C wave which started from 5944

C1 ended at 5196

C2 ended at 5740

C3 ended at 4720

C4 ended at 5400

C5-1 ended at 4640 or should end soon. If C5-1 ended at 4640, C5-2 can go uptil 4930, 5020 or 5109.

2. Historically, the area from 4539 to 4700 has a cluster of supports and will not breakdown so very easily. A bounce of 400-500 points is very much on the cards.

3. The downward sloping channel shows supports at 4430 and resistance at 5320.

4. The difference between 5 day moving averages and the 20 day moving average has moved near historic support levels. This implies a bounce is due.

5. Historically, the month of December has always been a positive month with gains above 5 pc. Hence, the next week may be the last week of the fall at least in the short term.

To summarize, buy at supports 4640 and play for a bounce in the month of December. It is also time to start building a portfolio of blue chips and for those interested, we have Lakshmi's Cherry Picks.

We work hard for our Money. Does our money work equally hard for us? Let us explore the world of financial markets together.

Sunday, November 27, 2011

Sunday, November 20, 2011

Chickens come Home to Roost

The markets were down about 5 % to close the week at 4906. All the gloom and doom predictions are slowly coming true. In all this bad news lies the seeds of the next bull run. Lets see what the future holds for the Indian economy.

1. Kingfisher huge debts are threatening to derail the airline industry. Kingfisher going bust or requiring a bailout as serious implications not only for the airline sector but the banking Sector. The government is talking about FDI in Aviation. This comes a bit too late. Who will invest in India's ailing airline sector and even if they do it will be at throwaway valuations.

2. The Banks are threatened by NPAs. Not only Kingfisher debts but also from the Power Sector. The biggest one to take the hit is State Bank of India. The defaults have just started and things will get much worse before they improve.

3. The Government auctions of 10 year bonds are devolving on the primary dealers. In layman terminology this means that no one is willing to buy bonds from the government at the Interest Rates being offered. The last bond auction devolved at 8.83 %. The Repo Rate is at 8.5%. This pretty much makes the case for holding rates redundant. If the most secure asset in India gives you an yield of close to 9 %, the banks will demand much more from the home loans.

4. Over the last few weeks, ICICI Bank has stepped up bombarding people's mailboxes with offers of flats at sale at much discounted rates. This is another sign that the NPAs of banks in terms of real estate sector loans are beginning to show up. As the layoffs increase and the distressed sales increase, expect the Balance Sheets of Banks to look much more horrible.

5.The mid caps are being slaughtered in the markets. The ones which have large FCCB holdings and the companies where promoters have pledged shares are the ones being hammered. The Mid-Caps are already at a level of Sensex being 10000. Pipavav Defence is an example of being circuit down at Rs 55.

6. Technically, the markets may have made their low 4838 for this settlement. Every rise can be sold into. The supports come at the 4800-4850 band after which comes 4720 and then 4500. The markets are oversold now on a delay basis and some amount of bounce can come to take the market to 5000-5050 levels.

7. Europe continues to struggle with the debt crisis. A discussion with one of my colleagues from Germany underlined the same. The issue is ow how much should Germany support the rest of Europe. The future of Euro is in question and now it becomes a question of national politics rather than just being pure economics. The next year brings elections in France and the US. Germany goes to the polls in 2013.

8. Channel support comes at around 4830.First resistance now will come at 4950. These are small trading ranges and are suitable only for traders. The direction is now very clear and it is on the way down. Not all stocks bottom at the same time and this is a rare opportunity to build a new portfolio from a clean slate.

Amidst this boom and gloom now is the time to start picking stocks which will survive the downturn and will do well with a 3-5 year perspective.We must look for companies which have less amount of debt on the books, have a market for their products and ones which will represent the new India. For those interested in stock picks we have Lakshmi's Investment Cherry Picks.

1. Kingfisher huge debts are threatening to derail the airline industry. Kingfisher going bust or requiring a bailout as serious implications not only for the airline sector but the banking Sector. The government is talking about FDI in Aviation. This comes a bit too late. Who will invest in India's ailing airline sector and even if they do it will be at throwaway valuations.

2. The Banks are threatened by NPAs. Not only Kingfisher debts but also from the Power Sector. The biggest one to take the hit is State Bank of India. The defaults have just started and things will get much worse before they improve.

3. The Government auctions of 10 year bonds are devolving on the primary dealers. In layman terminology this means that no one is willing to buy bonds from the government at the Interest Rates being offered. The last bond auction devolved at 8.83 %. The Repo Rate is at 8.5%. This pretty much makes the case for holding rates redundant. If the most secure asset in India gives you an yield of close to 9 %, the banks will demand much more from the home loans.

4. Over the last few weeks, ICICI Bank has stepped up bombarding people's mailboxes with offers of flats at sale at much discounted rates. This is another sign that the NPAs of banks in terms of real estate sector loans are beginning to show up. As the layoffs increase and the distressed sales increase, expect the Balance Sheets of Banks to look much more horrible.

5.The mid caps are being slaughtered in the markets. The ones which have large FCCB holdings and the companies where promoters have pledged shares are the ones being hammered. The Mid-Caps are already at a level of Sensex being 10000. Pipavav Defence is an example of being circuit down at Rs 55.

6. Technically, the markets may have made their low 4838 for this settlement. Every rise can be sold into. The supports come at the 4800-4850 band after which comes 4720 and then 4500. The markets are oversold now on a delay basis and some amount of bounce can come to take the market to 5000-5050 levels.

7. Europe continues to struggle with the debt crisis. A discussion with one of my colleagues from Germany underlined the same. The issue is ow how much should Germany support the rest of Europe. The future of Euro is in question and now it becomes a question of national politics rather than just being pure economics. The next year brings elections in France and the US. Germany goes to the polls in 2013.

8. Channel support comes at around 4830.First resistance now will come at 4950. These are small trading ranges and are suitable only for traders. The direction is now very clear and it is on the way down. Not all stocks bottom at the same time and this is a rare opportunity to build a new portfolio from a clean slate.

Amidst this boom and gloom now is the time to start picking stocks which will survive the downturn and will do well with a 3-5 year perspective.We must look for companies which have less amount of debt on the books, have a market for their products and ones which will represent the new India. For those interested in stock picks we have Lakshmi's Investment Cherry Picks.

Friday, November 18, 2011

Investment Strategies in Current Environment

The business channels and pink papers have been obsessive about high inflation in the Indian economy and the consequent rise in interest rates – and well they should be. The government doesn’t seem too perturbed about the deleterious effect that high inflation causes – not just to GDP growth, but also to the wallets of common citizens.

During such times, savings and investments may be farthest from people’s minds as they struggle to make both ends meet. However, there are some comparatively less risky investment opportunities that smart investors can avail of.

Continue Reading my guest post in Subhankar's blog:

http://investmentsfordummieslikeme.blogspot.com/2011/11/business-channels-and-pink-papers-have.html

During such times, savings and investments may be farthest from people’s minds as they struggle to make both ends meet. However, there are some comparatively less risky investment opportunities that smart investors can avail of.

Continue Reading my guest post in Subhankar's blog:

http://investmentsfordummieslikeme.blogspot.com/2011/11/business-channels-and-pink-papers-have.html

Sunday, November 13, 2011

Gloom and Doom Ahead

If one goes by the headlines, there is doom and gloom ahead. Airlines are going bust, people are being laid off, bond yields have crossed 9 pc and Italy tethers on the brink of a collapse. Lets us look at things in detail and try and find a silver lining to the cloud.

1. For any medium term upside, 5390 - 5400 remains the key resistance. There are a confluence of resistances here. The previous high comes at 5399, the 200 DMA comes at 5390 as also the lines joining previous tops from 6339 comes at this value. Prudence suggests that one should not go long before 5400 is breached.

2. On the downside, fresh shorts could be taken below 5072 and 5011, the previous significant bottom. We are in some kind of consolidation move right now. This expiry is 9 trading sessions away and we wait and watch. In this series it is only the Option writers who have made money.

3. Fundamentally, Kingfisher is in trouble. The problem is not as simple as an airline going bust. It has a cascading effect. Several banks have a very high exposure to the airlines and their NPAs will go up. The Power sector also has NPAs rising and banks will be wary of lending to the power sector as well.

4. The government bonds are trading at an yield of almost 9 pc. The Repo Rate is at 8.5 pc and will raise further in the month of December. The high yields imply that government bond supply is not being absorbed by the market. In simple language, government is borrowing big time from the markets.

5. Gold is also trading in a range. The previous top needs to be taken out for investments to be made in gold. The rupee has breached the psychological Rs 50 mark. Weak rupee means the companies which import are in trouble. India is an economy which is a net importer and hence the fiscal deficit target of 4.6 % is not likely to be met.

6. With elections in the key states of UP and Punjab round the corner expect no fiscally prudent measures from the government at least till March 2012.

Now, is the time to start nibbling at stocks, systematically picking the good companies. Those interested in stocks and gold investment advice, there is Lakshmi's Cherry Picks available.

Finally, a tailpiece on Austerity in these tough times by Sanil Sonalkar.

Financial year 2011-12 has truly marked the dawn of a new era of austerity measures being adopted by countries worldwide, caught in the midst of a recession which seems to be spreading by the day. The developed world, particularly the USA & the Eurozone countries, are grappling with huge debts and failure to pay sovereign obligations is becoming a stark reality. To tide over the crisis, these countries are resorting to unprecedented austerity measures in a ferocious bid to salvage pride and credit ratings (no pun intended).

Back home, the common man is increasingly feeling the burden of high prices and household budgets have taken a hit like never before - austerity begins at home too. The government,

almost belatedly, has tried to offer some respite by increasing the interest rate on the popular savings schemes - PPF, NSC, etc, etc. This may seem too little, too late.

A judicious mix of savings and investments is the order of the day in these troubled times.

1. For any medium term upside, 5390 - 5400 remains the key resistance. There are a confluence of resistances here. The previous high comes at 5399, the 200 DMA comes at 5390 as also the lines joining previous tops from 6339 comes at this value. Prudence suggests that one should not go long before 5400 is breached.

2. On the downside, fresh shorts could be taken below 5072 and 5011, the previous significant bottom. We are in some kind of consolidation move right now. This expiry is 9 trading sessions away and we wait and watch. In this series it is only the Option writers who have made money.

3. Fundamentally, Kingfisher is in trouble. The problem is not as simple as an airline going bust. It has a cascading effect. Several banks have a very high exposure to the airlines and their NPAs will go up. The Power sector also has NPAs rising and banks will be wary of lending to the power sector as well.

4. The government bonds are trading at an yield of almost 9 pc. The Repo Rate is at 8.5 pc and will raise further in the month of December. The high yields imply that government bond supply is not being absorbed by the market. In simple language, government is borrowing big time from the markets.

5. Gold is also trading in a range. The previous top needs to be taken out for investments to be made in gold. The rupee has breached the psychological Rs 50 mark. Weak rupee means the companies which import are in trouble. India is an economy which is a net importer and hence the fiscal deficit target of 4.6 % is not likely to be met.

6. With elections in the key states of UP and Punjab round the corner expect no fiscally prudent measures from the government at least till March 2012.

Now, is the time to start nibbling at stocks, systematically picking the good companies. Those interested in stocks and gold investment advice, there is Lakshmi's Cherry Picks available.

Finally, a tailpiece on Austerity in these tough times by Sanil Sonalkar.

Financial year 2011-12 has truly marked the dawn of a new era of austerity measures being adopted by countries worldwide, caught in the midst of a recession which seems to be spreading by the day. The developed world, particularly the USA & the Eurozone countries, are grappling with huge debts and failure to pay sovereign obligations is becoming a stark reality. To tide over the crisis, these countries are resorting to unprecedented austerity measures in a ferocious bid to salvage pride and credit ratings (no pun intended).

Back home, the common man is increasingly feeling the burden of high prices and household budgets have taken a hit like never before - austerity begins at home too. The government,

almost belatedly, has tried to offer some respite by increasing the interest rate on the popular savings schemes - PPF, NSC, etc, etc. This may seem too little, too late.

A judicious mix of savings and investments is the order of the day in these troubled times.

Sunday, November 6, 2011

A Party at Crossroads

There comes a time in every individual's or a nation's life where they stand at crossroads. Similarly, the Congress party has come to a point where they are at a crossroad. The next 24 months will decide where the party goes, and consequently where India goes. Our stock markets will be a reflection of where India is headed to.

In 1998, Sonia Gandhi took over as the Congress President. The Congress Party was in shambles. The BJP was riding a wave of Vajpayee induced euphoria, the Congress tally was plunging and no one gave the party a chance. Under Sonia, the party was losing election after election and no one gave the Congress much of a chance. Elections in May 2004 shook the nation and also shook the stock markets when Congress with the Left Front support came to power.

Sonia's masterstroke was yet to come. She stepped out of the race for the Prime Minister when the seat of power was hers to take. In one swift move she took the wind out of the sails of all those baying for her foreign origins. Manmohan Singh, an apolitical person, world renowned economist and more importantly a person with no political power took over as PM.

UPA - 1 was all about reforms. The Right to Information bill, the NREGA and the Nuclear bill being passed. In May 2009, the Congress came back to power minus the baggage of the Left Front. With great expectations come great responsibilities. It has been downhill after that with scams breaking out, inflation pinching the pockets of the Aam Aadmi and Congress being bruised in the by-elections.

Now, the news is Rahul Gandhi will become the Congress President, the 6th member of the Nehru Gandhi family to take over the reins of India's most influential party.

We have the elections in Uttar Pradesh in early 2012. The Congress has tied up an alliance with Ajit Singh who is powerful in Western UP. The Congress may emerge as the kingmaker as there seems to be no clear winner in UP. The Samajwadi Party, BSP, BJP and the Congress seem more or less equally placed with Mayawati edging ahead at the moment.

The real test of Rahul Gandhi will come in 2014. The Congress at the present moment is badly placed and is vulnerable to a defeat.

It is a real possibility that Manmohan Singh would be replaced in early 2012 after the elections in Punjab and Uttar Pradesh are out of the way. The most likely candidates to replace him are Pranab Mukherjee and P Chidambaram. The joker in the pack is someone like Kamal Nath.

It makes very real sense to replace Manmohan Singh. The scams and inflation have taken a toll on his image. It will be almost 7.5 years of him being in power. Time to have some old wine in new bottle.

The 3 leaders mentioned above have the same characteristics of Manmohan Singh. None of them are mass based leader and can never pose a threat to the Gandhi family.

Rahul Gandhi taking over as Prime Minister is the Ace in the Congress Pack ad I do not think, they will deploy that so early in the game.

What happens if Congress does not win in 2014?

There can be 2 alternatives. A NDA coalition coming to be power led by someone like Nitesh Kumar who has the credibility for good governance or a hotch potch Third Front government riding on the crutches of the Congress Party. This would lead to a repeat of the uncertainty of 1996-1998 period where the markets went no where basically.

Sonia Gandhi has left her footprints on the sands of Indian Political history. Let us wait and watch what Rahul Gandhi does.

Now, we come to our markets. Keeping all this in mind, I do not see the markets running away anywhere in a hurry. The crystal ball will become clear only sometime in mid 2012- 2014 period.

Now is the time to pick up blue chip stocks at good valuations. Invest in companies which will do well, keep 2015 as the target in mind.

For those interested in a selection of good stocks, Lakshmi has a pretty good collection very reasonably priced. One may contact her for her Investment Cherry Picks.

In 1998, Sonia Gandhi took over as the Congress President. The Congress Party was in shambles. The BJP was riding a wave of Vajpayee induced euphoria, the Congress tally was plunging and no one gave the party a chance. Under Sonia, the party was losing election after election and no one gave the Congress much of a chance. Elections in May 2004 shook the nation and also shook the stock markets when Congress with the Left Front support came to power.

Sonia's masterstroke was yet to come. She stepped out of the race for the Prime Minister when the seat of power was hers to take. In one swift move she took the wind out of the sails of all those baying for her foreign origins. Manmohan Singh, an apolitical person, world renowned economist and more importantly a person with no political power took over as PM.

UPA - 1 was all about reforms. The Right to Information bill, the NREGA and the Nuclear bill being passed. In May 2009, the Congress came back to power minus the baggage of the Left Front. With great expectations come great responsibilities. It has been downhill after that with scams breaking out, inflation pinching the pockets of the Aam Aadmi and Congress being bruised in the by-elections.

Now, the news is Rahul Gandhi will become the Congress President, the 6th member of the Nehru Gandhi family to take over the reins of India's most influential party.

We have the elections in Uttar Pradesh in early 2012. The Congress has tied up an alliance with Ajit Singh who is powerful in Western UP. The Congress may emerge as the kingmaker as there seems to be no clear winner in UP. The Samajwadi Party, BSP, BJP and the Congress seem more or less equally placed with Mayawati edging ahead at the moment.

The real test of Rahul Gandhi will come in 2014. The Congress at the present moment is badly placed and is vulnerable to a defeat.

It is a real possibility that Manmohan Singh would be replaced in early 2012 after the elections in Punjab and Uttar Pradesh are out of the way. The most likely candidates to replace him are Pranab Mukherjee and P Chidambaram. The joker in the pack is someone like Kamal Nath.

It makes very real sense to replace Manmohan Singh. The scams and inflation have taken a toll on his image. It will be almost 7.5 years of him being in power. Time to have some old wine in new bottle.

The 3 leaders mentioned above have the same characteristics of Manmohan Singh. None of them are mass based leader and can never pose a threat to the Gandhi family.

Rahul Gandhi taking over as Prime Minister is the Ace in the Congress Pack ad I do not think, they will deploy that so early in the game.

What happens if Congress does not win in 2014?

There can be 2 alternatives. A NDA coalition coming to be power led by someone like Nitesh Kumar who has the credibility for good governance or a hotch potch Third Front government riding on the crutches of the Congress Party. This would lead to a repeat of the uncertainty of 1996-1998 period where the markets went no where basically.

Sonia Gandhi has left her footprints on the sands of Indian Political history. Let us wait and watch what Rahul Gandhi does.

Now, we come to our markets. Keeping all this in mind, I do not see the markets running away anywhere in a hurry. The crystal ball will become clear only sometime in mid 2012- 2014 period.

Now is the time to pick up blue chip stocks at good valuations. Invest in companies which will do well, keep 2015 as the target in mind.

For those interested in a selection of good stocks, Lakshmi has a pretty good collection very reasonably priced. One may contact her for her Investment Cherry Picks.

Subscribe to:

Comments (Atom)